Unleash the power of SAP! Dive deep into sap fi sd integration, the secret weapon for seamless financial & sales alignment. Boost efficiency, optimize workflows, and ensure accurate accounting. Learn everything you need to know…

Have you ever stared at a mountain of paperwork, dreading the slog of reconciling sales figures with financial records? Imagine a world where your SAP system seamlessly bridges the gap between sales and finance, transforming your Order-to-Cash (O2C) cycle from a chaotic scramble into a smooth, well-oiled machine. This, my friend, is the magic of SAP FI-SD integration. By integrating the Finance (FI) and Sales & Distribution (SD) modules, you unlock a treasure trove of benefits: streamlined workflows, enhanced accuracy, and real-time insights that empower data-driven decision making. Buckle up, because we’re about to delve deep into the world of FI-SD integration, and show you how to harness its power to transform your business!

Key Components of sap fi sd integration

The magic behind a seamless Order-to-Cash (O2C) cycle in SAP often lies in the well-oiled integration between the FI (Finance) and SD (Sales & Distribution) modules. This integration ensures financial data flows smoothly from sales activities, creating a unified and accurate picture of your business performance. Let’s delve deeper into the key components that orchestrate this powerful connection:

2.1 Account Determination: The Backbone of Financial Mapping

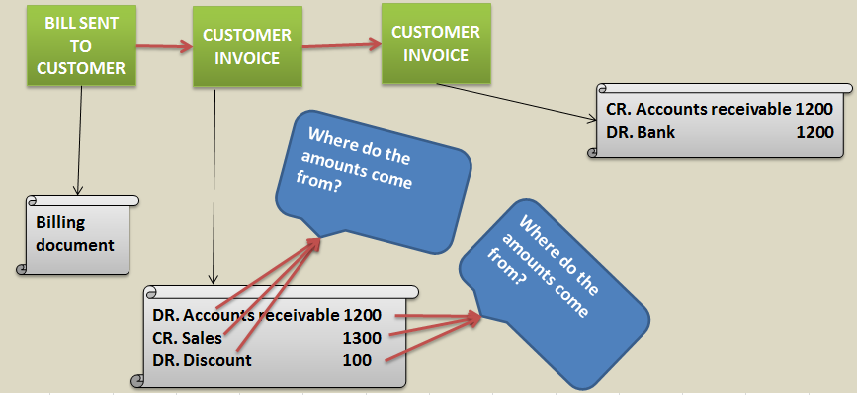

Imagine this: a customer places an order, but where do the resulting revenues get recorded in your financial books? This is where account determination comes into play. It’s the automated process of assigning the correct General Ledger (GL) accounts to every sales transaction.

Account determination hinges on a set of pre-defined rules that consider various factors. These factors can include:

- Customer Master Data: The customer’s classification (e.g., industry, location) can influence which revenue account is used.

- Sales Area: Different sales regions might have specific tax implications or require separate revenue tracking.

- Item Type: The type of product or service sold (e.g., finished good, service fee) determines the appropriate revenue and cost accounts.

By leveraging these factors, the system automatically assigns the relevant GL accounts. This not only saves time and minimizes manual errors, but also ensures consistency in your financial reporting.

VKOA: The Command Center for Account Determination Settings

For FI and SD consultants, transaction code VKOA acts as the mission control for configuring account determination rules. Here, they can define the criteria mentioned above and link them to specific GL accounts. VKOA offers a high degree of flexibility, allowing for account determination based on various combinations of factors. This level of control empowers businesses to tailor their financial mapping to their unique needs and accounting practices.

For instance, a company might configure VKOA to assign all sales of furniture (item type) to a specific revenue account, while sales of electronics (another item type) might be mapped to a different account. This granular control ensures a precise reflection of revenue streams within the financial statements.

Benefits of FI-SD Integration

A well-integrated FI-SD system acts as the backbone of a smooth-running business. By seamlessly connecting your sales and financial data, you unlock a multitude of advantages that empower your organization to operate at peak efficiency. Let’s delve deeper into the key benefits of FI-SD integration:

1. Enhanced Efficiency:

- Streamlined Workflows: Imagine a world where sales orders automatically trigger the creation of invoices and accounting documents. This eliminates the need for manual data entry across different systems, saving your team valuable time and resources. Sales reps can focus on closing deals, while finance teams can concentrate on strategic analysis, all thanks to the automation facilitated by FI-SD integration.

- Faster Order-to-Cash (O2C) Cycle: Every eliminated manual step translates to a faster O2C cycle. With FI-SD integration, sales orders are processed quicker, invoices are generated faster, and cash is collected efficiently. This improved speed translates to better customer satisfaction, increased cash flow, and the ability to capitalize on new business opportunities more readily.

2. Improved Accuracy:

- Automatic Postings and Account Determination: Manual data entry is a breeding ground for errors. FI-SD integration eliminates this risk by automating the assignment of General Ledger (GL) accounts to sales transactions. Predefined rules within the system ensure consistent and accurate account assignment, minimizing the chance of human error and ensuring the integrity of your financial records.

- Real-time Data Consistency: When your sales and financial data reside in separate systems, discrepancies can arise. FI-SD integration bridges this gap by ensuring real-time data consistency. All sales activities are automatically reflected in the financial system, providing a single source of truth for your financial reporting and analysis.

Configuration and Best Practices

Achieving a seamless FI-SD integration requires careful configuration and adherence to best practices. This section will delve deeper into these aspects, empowering you to optimize your system for maximum efficiency and accuracy.

Role of Consultants

Configuring FI-SD integration involves expertise from both FI (Finance) and SD (Sales & Distribution) consultants. FI consultants ensure the proper setup of the chart of accounts, account determination procedures, and revenue/cost accounts. SD consultants, on the other hand, configure pricing procedures, sales order types, and item categories. This collaborative approach guarantees a holistic integration that aligns financial processes with sales activities.

Maintaining Accurate Master Data

The foundation of successful FI-SD integration lies in accurate and consistent master data. This includes:

- Customer Master Data: Customer data like customer number, tax codes, and payment terms should be meticulously maintained in the SD module. This data directly impacts account determination and ensures accurate postings to customer accounts in the FI module.

- Material Master Data: Information like material type, valuation category, and account assignment group in the material master (MM module) plays a crucial role. During deliveries and invoices, the system automatically retrieves relevant data for cost of goods sold (COGS) calculations and proper inventory updates in FI.

Here’s why maintaining accurate master data is crucial:

- Ensures Data Consistency: Up-to-date master data eliminates inconsistencies between sales and financial data, preventing errors and reconciliation issues.

- Automates Processes: Accurate data allows the system to automate account determination, pricing calculations, and financial postings, saving time and minimizing manual intervention.

Best Practices for FI-SD Configuration

Here are some key best practices to consider when configuring FI-SD integration:

- Define Clear Account Determination Rules: Establish clear and well-defined rules for assigning G/L accounts to sales transactions. Utilize a combination of factors like customer group, sales area, material type, and condition type to ensure precise account assignments.

- Regular Review and Updates: The business landscape and accounting practices can evolve over time. Regularly review and update your FI-SD configuration to reflect changes in tax laws, new product lines, or revised costing methods. This ensures your system remains aligned with your current business needs.

Conclusion

In conclusion, a well-integrated SAP FI-SD system acts as the backbone of a smooth-running business. By automating data flow, account determination, and pricing procedures, you achieve a streamlined Order-to-Cash cycle, minimize errors, and gain real-time financial insights. This translates to significant benefits – increased efficiency frees up resources for strategic initiatives, improved accuracy fosters trust in financial reporting, and data-driven visibility empowers informed decision-making. Remember, proper configuration and best practices are crucial for maximizing the value of FI-SD integration.

Ready to unlock the full potential of your SAP system? Consider exploring resources on FI-SD configuration or contacting SAP specialists for implementation assistance. A well-integrated FI-SD system is a powerful tool for gaining a competitive edge – don’t wait to streamline your operations and elevate your business to the next level.

you may be interested un this blog here:-

“Engage Young Minds with UKG Class EVS Worksheets for ukg: Fun & Educational!”