Understanding the importance of SAP year end activities in SAP fico activities will help you navigate the complex finance and controlling modules. Despite their formal-sounding name, they are rather straightforward. These tasks, carried out at the end of each month and year, play a crucial role in determining an organization’s financial situation. To help clarify what general ledgers (GL) and asset accounting are and how to avoid common mistakes, let’s take a look at the major milestones that affect both.

Nearing the end of the year, companies encounter a critical period for financial operations. Strategic preparation, rigorous execution, and a complete understanding of year-end operations are required in the arena of SAP FICO (Financial Accounting and Controlling) during this period. For a smooth transition into the new fiscal year, it is necessary to navigate year-end tasks in SAP FICO, such as closing financial books and assuring compliance.

Understanding Year End Activities in SAP FICO

The accounting department is tasked with regularly performing system closure in SAP S4 HANA Finance after each month and the end of the year. Thus, it is imperative that you, in your role as the SAP S4 HANA Finance consultant, possess a comprehensive understanding of these SAP closure procedures.

The closure of each fiscal year in SAP Financial Accounting must adhere to the predefined fiscal year variants and calendars established during system deployment. The required actions will vary among companies depending on their distinct software and operations. However, to finalize the fundamental submodules in SAP Financial Accounting, the majority of companies follow traditional standard protocols. Acquire comprehensive knowledge of the SAP Year-End Closing Process through a succinct course that guides you through each phase, encompassing the transactions and program displays.

Before engaging with this lesson on the SAP Year End Closing Process, you must familiarize yourself with the tutorial on the SAP Month End Closing Process.

Before executing the year-end closure, SAP often does a traditional period-end close for the final fiscal period of the year. This involves handling specific reports, transactions, and procedures to eliminate year-end entries and transfer balances to the following year. The financial accountants collaborate with the SAP functional and basis support staff to execute a sequential approach for doing the last period-end closure and year-end close concurrently. This is frequently done due to time constraints associated with calendar modifications and system schedules. Although we won’t delve into specifics in this context, certain common occurrences often take place in the days preceding the final closure:

Important Benefits of Simplifying Year-End Activities

Streamlining SAP FICO’s year-end routines has many benefits, including:

- Ensure financial reports and papers are accurate.

- Adherence involves following regulations and reducing hazards.

- Combining operations speeds up closing times.

- Intelligent reporting: More information simplifies next-year decisions.

- Allowing long-term plans boosts productivity.

Year-end activities in sap fico

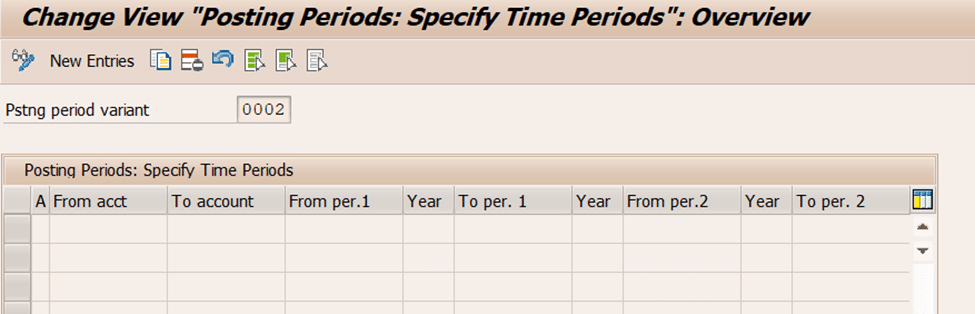

Year-End Closing: Every business that was open during the fiscal year has to close at the end of the year.Open posting period for next yr (T.Code: OB52)

100vw, 975px” data-lazy-src=”https://www.saptutorials.in/wp-content/uploads/2023/12/image-1.png” /> </picture><noscript><picture decoding=)

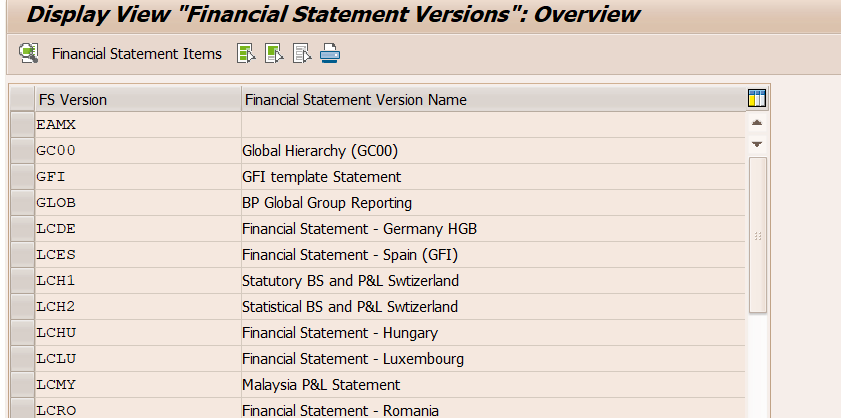

Audits of Financial Statements: If inspectors ask you to, put together financial statements and any supporting paperwork for an external audit. The financial statement version is defined and summarized using T codes OB58 and F.01.

100vw, 841px” data-lazy-src=”https://www.saptutorials.in/wp-content/uploads/2023/12/image-6.png” /> </picture><noscript><picture decoding=)

Depreciation and Amortization Adjustment: Make any necessary changes to the depreciation and amortization schedules for the end of the fiscal year, taking into account any new or changed asset values or predicted lifespans.If further depreciation needs to be written to the asset in issue, you can either utilize the ABZU write-up to amend the accumulated depreciation or the unplanned depreciation ABAA method.

Inventory Valuation: If necessary, reevaluate the value of the inventory, taking into account things like items that are no longer useful or changes in the market value. Typically, you’ll see the flag : Allowed previous posting period while conducting MMPV. The system will be able to post the documents in both the current and past periods because it will be flagged.As it selects from Valuation, the system automatically updates the stocks and value once the Mat-doc is posted.

100vw, 750px” data-lazy-src=”https://www.saptutorials.in/wp-content/uploads/2023/12/image-3.png” /> </picture><noscript><picture decoding=)

Provision for Bad Debts: Scroll down and look over the provision for bad debts. Based on how old the accounts are and past data, make any changes that are needed. The reason code was altered by FB02 and is now Bad Debt.

Tax Year-End Tasks: Fill out and send in your yearly tax returns, including your income tax returns, and make sure you’re following all the tax rules.

Disclosure and Financial Reporting: For outside partners, make yearly financial reports that include the balance sheet, income statement, and cash flow statement.

Carry Forward funds: Move funds from the old fiscal year to the new calendar year.

Archiving Data: To make sure the system works well and meets legal standards, you should archive data for the last fiscal year.

Planning for the New Fiscal Year: Setting up new fiscal year variants and planning situations is part of the step-by-step process of closing out the fiscal year. All open times for the year must also be closed.

Month-end activities in sap fico

Reconciliation of Accounts: Account balancing is the process of making sure that all of your accounts are in order. This includes bank accounts, seller accounts, user accounts, asset accounts, and more.

Accruals and Deferrals: For correct financial reporting, accruals and deferrals mean making the changes that need to be made and keeping track of when money comes in and goes out. Look over all the written notes that were made in the journal during the month and make sure they are correct. If there are any mistakes, make the necessary changes. A single transaction can carry over from one financial period to the next and automatically undo provisional entries filed for closing using SAP’s Accruals and Deferrals feature. Please input the Accrual / Deferral Document using the following Tcode: FBS1.

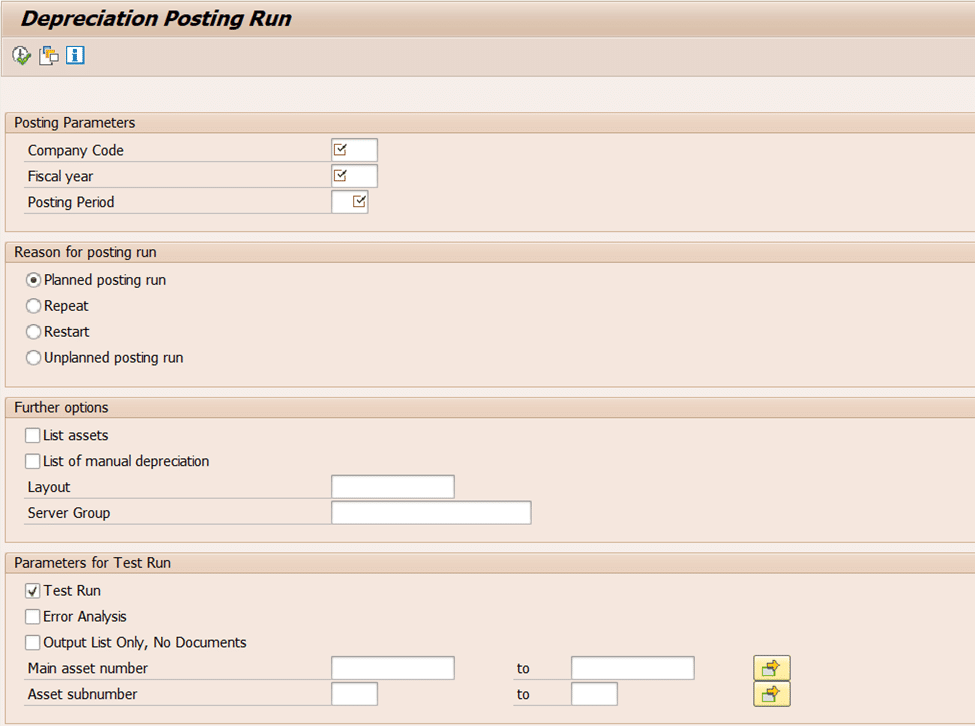

Depreciation Run: You can use the depreciation process to figure out and keep track of the costs that come up every month because fixed assets are lost value.Run Depreciation in Test Run and post (T.Code: AFAB)

100vw, 975px” data-lazy-src=”https://www.saptutorials.in/wp-content/uploads/2023/12/image-2.png” /> </picture><noscript><picture decoding=)

Foreign Currency Valuation: Value in a Foreign Currency: Check that the values given for the deals in foreign currencies are right and up-to-date with the current exchange rates. Putting together the details that buyers and sellers have given: Bring together the records of both the service providers and the clients to make sure that all outstanding bills and financial transactions are correctly recorded. Foreign Currency Valuation can accessed via tcode-F.05

100vw, 926px” data-lazy-src=”https://www.saptutorials.in/wp-content/uploads/2023/12/image-4.png” /> </picture><noscript><picture decoding=)

Bank Reconciliation:Bank reconciliation is the process of comparing and adjusting bank balances with SAP records in order to identify and rectify any discrepancies.

Financial Statement Preparation:Produce financial statements, such as the income statement, balance sheet, and cash flow statement, for the designated month.

Tax Calculations and Reporting: Identify and file relevant taxes, such as sales tax or value-added tax (VAT).

Closing Activities: Execute diverse closing procedures in SAP, encompassing the completion of ongoing time periods, adjustment of entries, and, if required, the storage of data.

Closing Cockpit: Use the Closing Cockpit to plan and carry out closing processes correctly. Keep an eye on how tasks are going and make sure that each step is done correctly.

Run Financial Statements: You can make financial statements like the balance sheet, income statement, and cash flow statement using SAP report tools. Check that the numbers are correct and look into any big differences.

Tax Reports: Write detailed reports on many tax-related topics, like tax forms and financial statements. Make sure that all deals use the most up-to-date tax rates and codes.

Vendor and Customer Reconciliation:Comparing the open things in the vendor and customer accounts to make sure they are equal is what Vendor and Customer Reconciliation is all about. Take out any open parts and carefully look into and fix any problems you find.

Internal Order Settlement: Put the costs of internal orders in the right cost groups or projects. Check the offers to see if they meet the project’s needs and fit within the budget.

Review Controlling Reports: They should have a study of variation for both the cost centers and the earnings centers. Take a look at any big differences and make the necessary changes.

Data cleaning and archiving: To get the most out of your system, you should get rid of old data. To get the most out of your system’s resources, you should get rid of old data like master data or papers that aren’t being used.

Document Parking and Posting: Make sure that all papers that have been parked are carefully looked over and then posted. Take care of any problems with papers that aren’t in the right place and make sure they have the right permissions to be displayed.

Evaluation of the Audit Trail: Look at the audit logs to see what changes were made at the end of the process. Make sure that any changes you make to financial information are properly recorded and approved.

Data Backup and System Audits: Make sure your data is safe by making copies of your system on a regular basis. Check your system carefully to find any problems, and fix any problems right away if they’re the cause of it running less smoothly.

Conclusion

Mastering SAP FICO year-end responsibilities is critical to the operational and financial health of any business. By fully utilizing SAP FICO’s features and becoming proficient with the procedures, businesses can confidently and precisely navigate this hard moment.

Mistakes in year-end closing can throw off the beat, just like a missing chord in a melody. Fixes are necessary for each issue, such as missing or incomplete asset data or unposted values. A perfect financial symphony is guaranteed by mastery of these subtleties. Conducting a big symphony, with each movement leading to financial harmony, is like navigating SAP FICO’s closing activities. By deciphering their intricacies, one can achieve a more streamlined and error-free financial performance.