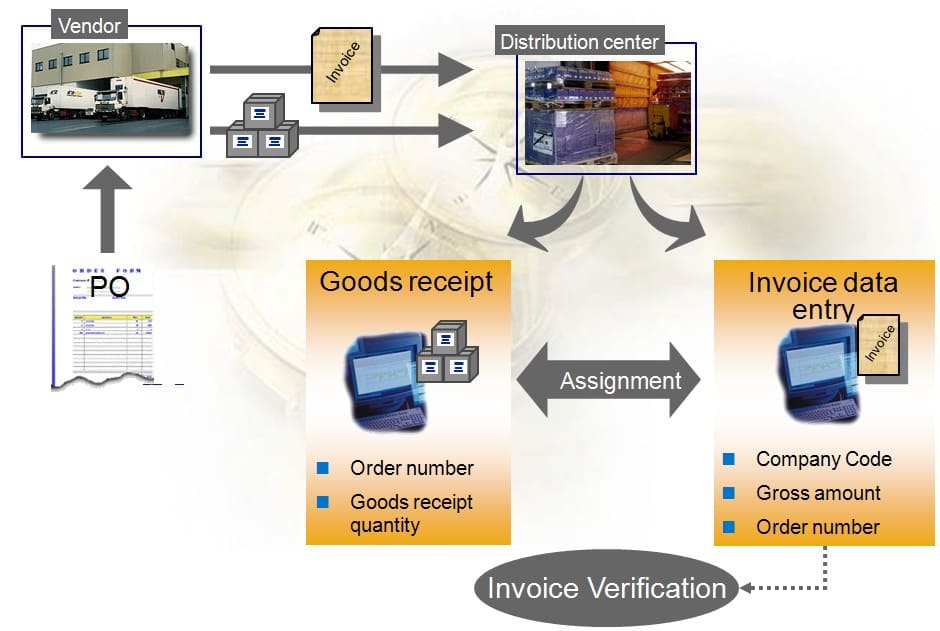

VERIFICATION OF VENDOR INVOICES

- The Materials Management Document contains detailed information on the invoice verification procedure.

The following entry will be made after the vendor bill is received: - Vendor Account CR; GR/IR Account DR; Freight Clearing Account DR; Cenvat Clearing Account DR

Verification of Invoice for Foreign Vendor

The following entry will be made after the vendor bill is received:

- Account Type: GR/IR DR

- Supplier Account CR

Verification of Invoice for Special Vendor

The following entry will be made after the vendor bill is received:

1) Part 2 A/C of RG 23A/RG 23C (CVD) Account DR Cenvat Clearing Account CR

2) Cenvat Clearing A/c DR and G/R I/R A/c DR

Supplier Account Number

3) Material Account Cost (DR) Vendor Account (Customs) CR

Verification of Invoice for Freight and Clearing Agent; Material Cost A/C DR; Vendor A/C (Clearing Agent) CR

- Verification of Invoice for Octroi Expenses

Vendor A/c (Octroi) CR Cost of Material DR - For service orders, TDS (Work Contract Tax) must be computed and subtracted appropriately.

Upon the passage of the measure, the following entry will be made: - The Costs Account DR

Supplier Account CR

TDS Account CR - Exchange discrepancies for capital items from import vendors must be manually recorded using a journal voucher for capitalization.

Differences in exchange rates will be recorded at HO. An illustration of the accounting entry in this scenario would be:

- Bill input at 40 INR = 1 USD

- Account for Asset/Expense DR 100

Provider A/C CR 100 - $1 USD at 41 INR for payment entry

Vendor account number 100

Bank Account Number (CR) 110

Capital A/c DR 10 Exchange rate loss

Exchange rate loss Capital A/c CR 10 Exchange rate loss Asset A/c 10

- For the unique G/L transactions, a new G/L account needs to be formed.

- The down payment will be recorded in the accounting as follows:

- Paying ahead to the supplier account

- Debit Bank Account Credit

The protocol should be adhered to is:

Definition of alternative accounts payable reconciliation used to post capital asset down payments

clearing the final invoice together with the upfront payment in accounts payable.

For the unique G/L transactions, a new G/L account needs to be formed.

The down payment will be recorded in the accounting as follows:

Vendor Advance for Capital Goods Account Credit/Debit from Bank Account

- Upon booking the invoice, the subsequent entry is made.

A/C Asset and WIP Asset Debit Account Number of Vendor Credit

Invoice clearance for the down payment

The vendor’s account number

Vendor Advance for Credit on Capital Goods Account - The TDS Rates are as follows (must be verified with the recent modifications)

Specifics Rate of Surcharge on Tax Rate 194 C contractors in total 5% 2.10% 2%

Promotion – 194 C 1% to 5% 1.05%

Professor Fees: 194 J 5% 5% 5.25%

Other Rent: 194 I 15% 5% 15.75%

Company rent: 194 I 20% 5% 21%

194H 5% 5% 5.25% Commission

194 A 10% 5% 10.50% Interest-Others

Interest: 194 A 20% 5% 21% Company

Works Contract Tax Special Concessional Tax - The vendors’ security deposits and the oldest money deposits received from them are as follows: Bank A/c DR Security Deposit Vendor CR

- In order for the EMD to be transferred to an unclaimed EMD account, the age must be provided.

TOUR ADVANCE PAYMENT FOR DOMESTIC TOURS

you may be interested in this blog here:-

How Many Employees Does Salesforce Have in 2024?