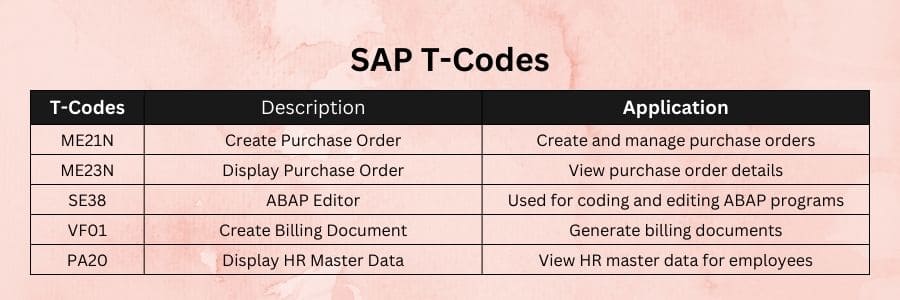

Details of T Codes

Accounting for Finances

SPRO Put in the IMG OX02 Company Code to Create, Verify, and Delete OX03. Create Business Area

Functional Areas for OKBD

OB45 Establish a Credit Control Zone

Maintaining the Fiscal Year Variant (OB29)

OB37: Assign Co. Code to Variant Fiscal Year

OB13: Chart of Account (CoA) Creation

OBY7: Copy the Accounts Chart (CoA)

OBY9: Account Transport Chart OBD4: Account Group Definition

OBY2: Transfer GL Accounts to Co. Code from the Chart

OB53 Define Retained Earnings

OB58 Maintain Financial Statement Versions

OBC4 Maintain Field Status Variant

OBBO Define Posting Period Variant

OBA7 Define Document Type & Number Ranges

OB41 Maintain Posting Keys

OBA4 Create Tolerance Groups

FBN1 Create GL Number Ranges

OBL1 Automatic Posting Documentation

FBKP Automatic Account Assignment

OBYC MM Automatic Account Assignment

OBY6 Enter Global parameters

FS00: Establishing GL Master Records

(F-02) GL Transaction Posting

(FB03) GL Document Display (FS10N) GL Accounts display

OB46 Describe Types of Interest Calculations

Define Vendor Account Group (XK01) in OBD3. Establishing the Vendor Master (F-43) Posting of Purchase Invoice (FK10N) F112 Vendor Account Display Describe House Bank

OBB8 Maintain Terms of Payment (ToP)

OBD2: Customer Account Group Creation

Customer Tolerance Groups (XD01) for OBA3 Customer Master (FD10N) creation Show Client Account (F-28) posting of incoming payments

OB61 Describe the Dunning Area

EC08 Copy of the Depreciation Reference Chart (CoD)

Depreciation Area Definition by OADB

OAOB Assign Chart of Depreciation to Co. Code OAOA Define Asset Class

AO90 Account Assignment in the Asset Class

OAY2: Depreciation Area Calculation in Asset Class (AS01) Establishing the Asset Master (AS11)Creation of Sub Asset

(F-90) Asset Purchase Posting

(AFAB) Depreciation Run

(F-92) Asset Sale Posting

(AW01N) Asset Explorer

Explain the difference between INVOICE and BILLING in SAP.

In terms of SD, both are equal.

– We refer to this in FI terminology as an INVOICE, and in SD terminology as a BILLING DOCUMENT.

– Once more, only INVOICE will be available to vendors in MM.

An invoice is a document that certifies the delivery of goods, and a billing is a payment receipt.

An invoice is created when items are given to a client; a bill is created when goods are received from vendors.

Bills indicate that we must pay the amount shown on them; invoices indicate that we must receive the amount shown on them.

The invoice is for both the customer’s and the vendor’s invoice.

Billing Tcodes: VF01 generates a billing record. The delivery order appears automatically.

VF02: The billing document opens automatically. Examine the accounting entries

T codes for invoices: – FB60 Create invoice with respect to raw material and tax.

– Sales and tax inputs in the FB70 invoice

Also read :

Is Salesforce CPQ Trailhead Good Choice to Learn?

The Future of Media Consumption: What Tech Buyers Expect in 2024 and Beyond…