Introduction

Every firm must complete the Financial Statement Closing T codes process to guarantee that the financial records for a given time period are accurate and comprehensive. This procedure is supported by a set of transaction codes (T-codes) in SAP (Systems, Applications, and Products in Data Processing), which are intended to automate and simplify the financial closing procedures. For accountants, financial analysts, and SAP users engaged in month-end, quarter-end, and year-end closing procedures, these T-codes are crucial resources.

What is Financial Statement Closing?

The process of completing an organization’s financial statements at the conclusion of a given time frame, like a month, quarter, or year, is known as financial statement closing. It includes a number of crucial duties, such as:

- posting accrual, provisional, and adjustment journal entries.

- balancing accounts to guarantee the veracity of the data.

- creating financial reports, such as the profit and loss statement and balance sheet.

- closing general ledgers and sub-ledgers.

- confirming that every transaction has been accurately documented.

Key SAP T-Codes for Financial Statement Closing

To help with the financial statement closure process, SAP provides a number of transaction codes, or T-codes. Every T-code denotes a distinct activity or function inside the process as a whole. Let’s examine some of the most crucial T-codes for closing financial statements in more detail.

1. F.01 – Financial Statements

- Financial statements like the balance sheet and profit and loss statement are produced using the T-code F.01. In order to generate the necessary financial reports, users can choose the precise reporting period and additional parameters using this operation. After all closing procedures, the F.01 T-code is essential to guaranteeing that the financial statements are produced correctly and represent the right financial data.

2. F.16 – Clear Vendor Accounts

- An essential phase in the financial closing process is clearing vendor accounts, which is accomplished with the F.16 T-code. Any outstanding items in the accounts payable sub-ledger are reconciled by clearing the vendor accounts, guaranteeing that the financial records are current prior to the period’s conclusion.

3. F-02 – Post Document

- Journal entries can be posted to the general ledger using the F-02 T-code. Because it allows users to document any accruals, adjustments, or corrections that must be made for the closing period, this transaction code is among the most often utilized in the closure process.

6. F.14 – Automatic Payment Program

- The SAP automatic payment program, which makes it easier to settle open items in the accounts payable and accounts receivable ledgers, is operated with the F.14 T-code. By ensuring that all payments are completed accurately prior to the period ending, this application helps to minimize errors and guarantee on-time payment.

7. F-28 – Post Incoming Payments

- Incoming customer payments are posted to the accounts receivable sub-ledger using the F-28 T-code. Before the period is closed, it is essential to make sure that the accounts receivable ledger is updated with the accurate payments.

8. F-32 – Clear Customer Open Items

- Clearing open items in client accounts is done with the F-32 T-code. As a component of the reconciliation process, this transaction guarantees that all customer transactions are accurately documented and balanced prior to closing.

9. OB52 – Maintain Posting Periods

- In SAP, posting periods are maintained and managed using the OB52 T-code. Users can choose which time frames are open or closed for publishing transactions using this feature. It is crucial to make sure that the posting periods for the pertinent period are appropriately closed before the financial closing can take place. This will stop any fresh transactions from being posted following the closing procedure.

10. F.11 – Post Documents for Period Closing

- Any closing entries that are required for a period are posted using the F.11 T-code. It enables users to publish accruals, make adjustments, and make other required entries to close out the accounting period. Before the period is formally closed, this T-code is crucial for making sure that all financial operations during the time are accurately documented.

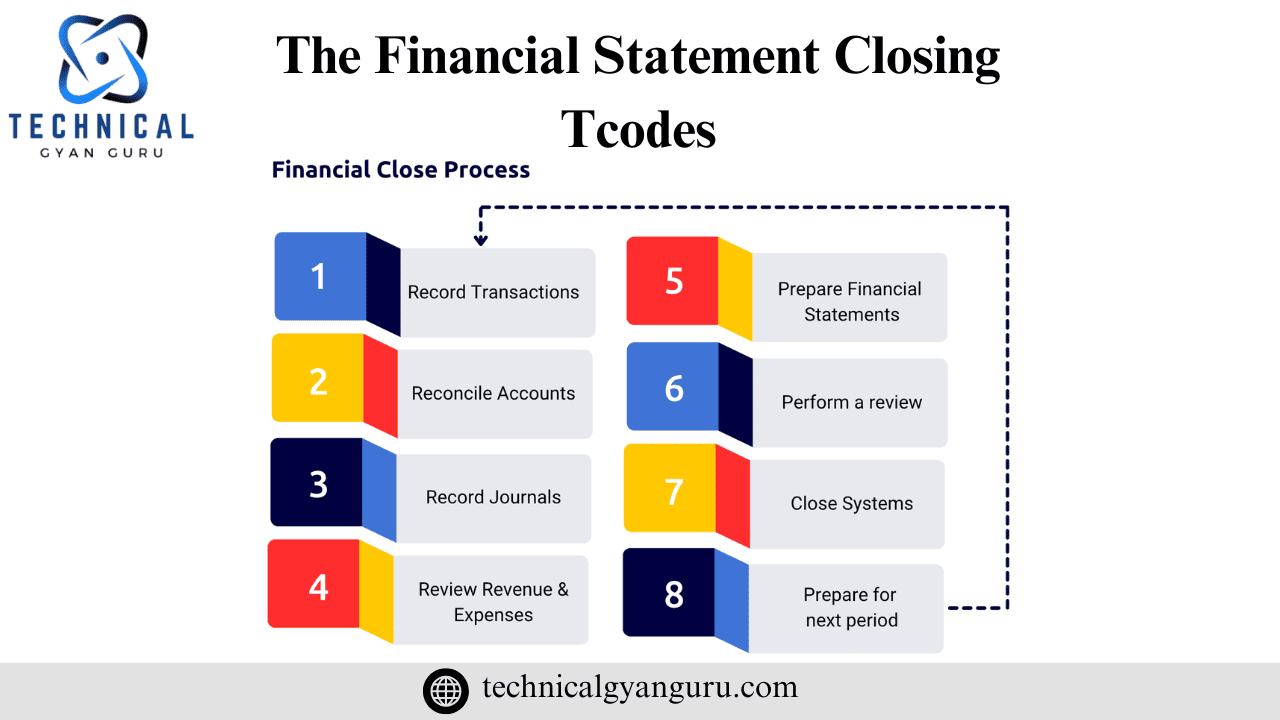

The Financial Closing Process in SAP

There are multiple important steps in the SAP financial statement closure process. An outline of the steps involved is shown below, along with the T-codes that are utilized at each stage:

Phase 1: Preparation for Closing

The closing program can begin after all required transactions have been documented and balanced. In this stage:

- Use F-02 to confirm that every journal entry has been submitted.

- Account reconciliation for customers and vendors (using F.16, F-03, F-32).

- Examine and resolve any outstanding issues (using F.16, F-28).

- Using OB52, keep track of and verify the posting periods.

Phase 2: Running the Closing Program

The closing program can begin after all required transactions have been documented and balanced. In this stage:

- Financial statements are generated using F.01.

- Any completed documents are posted using F.11.

- Closing entries for accounts payable are posted using F.07.

Phase 3: Post-Closing Activities

Following the posting of the closing entries, it’s critical to confirm that everything has been accurately recorded:

- To confirm that the financial accounts are accurate, run the F.01 report once more.

- Make that the general ledger and all sub-ledgers are in sync.

- Use F-02 or F.11 for any last-minute alterations or fixes.

Best Practices for Using T-Codes in Financial Statement Closing

- Planning and Coordination: Make sure the financial closing procedure is organized well in advance. To guarantee that all required tasks are finished on schedule, the accounting and finance teams must properly coordinate.

- Training and Knowledge: Ensure that every user has received enough instruction on how to use the T-codes associated with financial close. Errors during the closing process can be avoided by being aware of the individual T-codes and their functions.

- Automation: Use SAP capabilities such as the automatic payment program (F.14) and automatic posts in F-02 to automate repetitive processes whenever feasible. In addition to saving time, this lowers the possibility of human error.

- Regular Reconciliation: Make sure that accounts are current by regularly reconciling sub-ledgers. Before closure, T-codes like F.16 and F-03 can help make sure that vendor and customer accounts are clear.

- Testing and Verification: Prior to implementing the closing procedure in a live setting, it is always necessary to test it in a test environment. This can assist in spotting possible problems before they have an impact on financial reporting.

Conclusion

- Any firm must complete the financial statement closure process to guarantee that its financial records are current and accurate. T-codes from SAP are essential for expediting this procedure, automating a lot of the required work, and lowering the possibility of mistakes. SAP users can guarantee a precise and seamless financial closing procedure, resulting in timely and trustworthy financial reporting, by comprehending and utilizing the different T-codes.

- Having a firm grasp of these T-codes can help you handle your financial statement closure procedure properly and efficiently, regardless of whether you’re an accountant or a SAP user.

YOU MAY BE INTERESTED IN